Direct Mail Marketing Leader

in Canada

Reaching every home in Canada, we help businesses target and reach their most qualified prospects at home, in their mailbox by leveraging the power of data, analytics, and digital integrations.

.png)

SOLO DIRECT MAIL

Increase your response rate and have your brand stand out by communicating one-to-one with prospects through a solo postcard, menu, or brochure.

SHARED DIRECT MAIL

Increase your reach and lower your cost by sharing the cost of postage with local, regional, and national advertisers.

DATA & TARGETING

We use first-party data as well as third-party data partnerships to offer demographic, behavioural, and customer-based analysis and targeting.

Direct Mail Products in Canada

SOLO DIRECT MAIL

Stand out in prospect's mailboxes through postcards, menus or brochures.

.png?width=200&height=150&name=Untitled%20design%20(60).png)

What Product Fits Your

Business?

Compare our Direct Mail products by Areas Served, Reach, Issues per Year, Targeting Capabilities, Personalization, and More.

Our Technology

-

Insight Dashboard

-

Call Tracking

-

QR Code Tracking

-

Audience Targeting

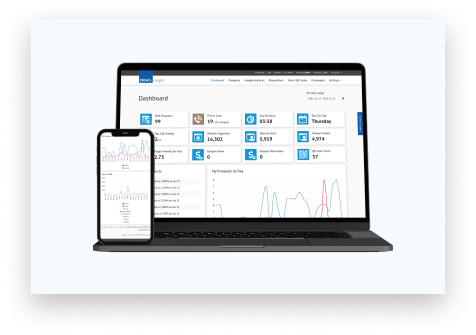

Insight Dashboard

Monitor and measure the effectiveness of online and offline marketing efforts in one centralized location.

Call Tracking

Add a call tracking number to your campaign to evaluate calls and the return on investment from your Direct Mail campaign all in our DRMG Insight platform.

QR Code Tracking

Add a QR code to your campaign to make your website or App one scan away and gain valuable consumer insight through scan data in our DRMG Insight platform.

Audience Targeting

Target customers based on our demographic data available for each Zone including population characteristics, income brackets, and household details.

Canada Post Expert Partner

As a Smartmail Marketing Expert Partner, we can pass on exclusive offers, targeting, and demographic insights to our clients.

.png)

Who We Serve

With unique solutions for every business across Canada, learn what products are the best fit for you.

National Brands

Reach 100% of Canadian households while hyper-targeting neighborhoods, postal walks, and individual households based on demographic and behavioral data.

Regional & Franchise

Reach 100% of Canadian households while hyper-targeting neighborhoods, postal walks, and individual households based on demographic and behavioral data.

Local & Small Business

Target your local community easily with our one-stop-shop. Design, printing, delivery plus demographic, and targeting data options all in one place for an affordable cost.

Business Resources

Stay up to date on the latest Canadian marketing, sales, direct mail tips, and news.

Get Started With Direct Mail

Start attracting, engaging and retaining more customers at home, right in their mailbox.